Maybe you need all the help.

Maybe you only need a little.

With BELAY’s customizable outsourced financial team, we have just the right solution for you and your growing organization.

Our Accounting Professionals are experts at delivering transparent, streamlined, and accurate GAAP-compliant financial information, managing accounts payable and receivable, and generating precise monthly and annual reports — supported by AI-enhanced tools for added accuracy and efficiency. This empowers you to steer your organization efficiently, enhance your ability to analyze operations, and make informed decisions for the growth of your organization.

Learn More About BELAY'sBookkeeping Services

BELAY’s outsourced accounting services go beyond basic bookkeeping — think of us as your complete financial team. As your virtual accounting department, we handle everything from bank reconciliations and invoicing to payroll processing, sales tax filings, and financial reporting, enhanced by AI-powered tools for greater accuracy and efficiency.

With a team of professional bookkeepers and CPAs, we offer a bundled, back-office solution to keep your finances in order so you can focus on growing your business. Let us take the stress out of accounting while you lead with confidence.

Learn More About BELAY'sOutsourced Accounting Services

We support CPG companies and inventory-based businesses that manage, restock, and sell inventory. Our team streamlines processes — leveraging AI-powered insights — to create efficient, scalable operations.

With regular financial and inventory reviews, we help you stay ahead on order fulfillment, sales channels, and restocking. Whether you need an inventory management system or support for an existing one, our experts handle implementation, consulting, technical support, and data maintenance — so you can focus on growth.

Learn More About BELAY'sInventory Consulting Services

Accounting Clerks, adept financial professionals, wield their data-entry expertise to seamlessly support accounts payable, accounts receivable, and other vital transactional processes integral to the bookkeeping cycle. Leveraging AI-enhanced tools for greater accuracy and speed, they diligently organize documents and expertly apply incoming and outgoing payments with precision to ensure accurate account management.

Learn More About BELAY'sAccounting Clerk Services

Empower your business with a proactive BELAY Accounting Professional who skillfully manages every facet of payroll so you don’t have to.

From efficiently processing payroll and facilitating direct deposits to conducting precise payroll calculations and generating comprehensive year-end tax reports, our Accounting Professionals — supported by AI-enhanced tools—handle quarterly and year-end tax filing and payments with precision, going above and beyond for your financial peace of mind.

Learn More About BELAY'sFully Managed Payroll Services

Our expert CPAs handle business and personal tax preparation, ensuring compliance and minimizing stress. We review legal and tax structures for new and restructuring companies, offer strategic planning for future liabilities, and help resolve past filing issues—with the support of AI-enhanced tools for greater accuracy and insight.

Year-round, we provide tax advisory services, manage quarterly, sales, franchise, and personal property tax payments, and handle 1099 filings — so you can focus on what matters most.

Learn More About BELAY'sTax Services

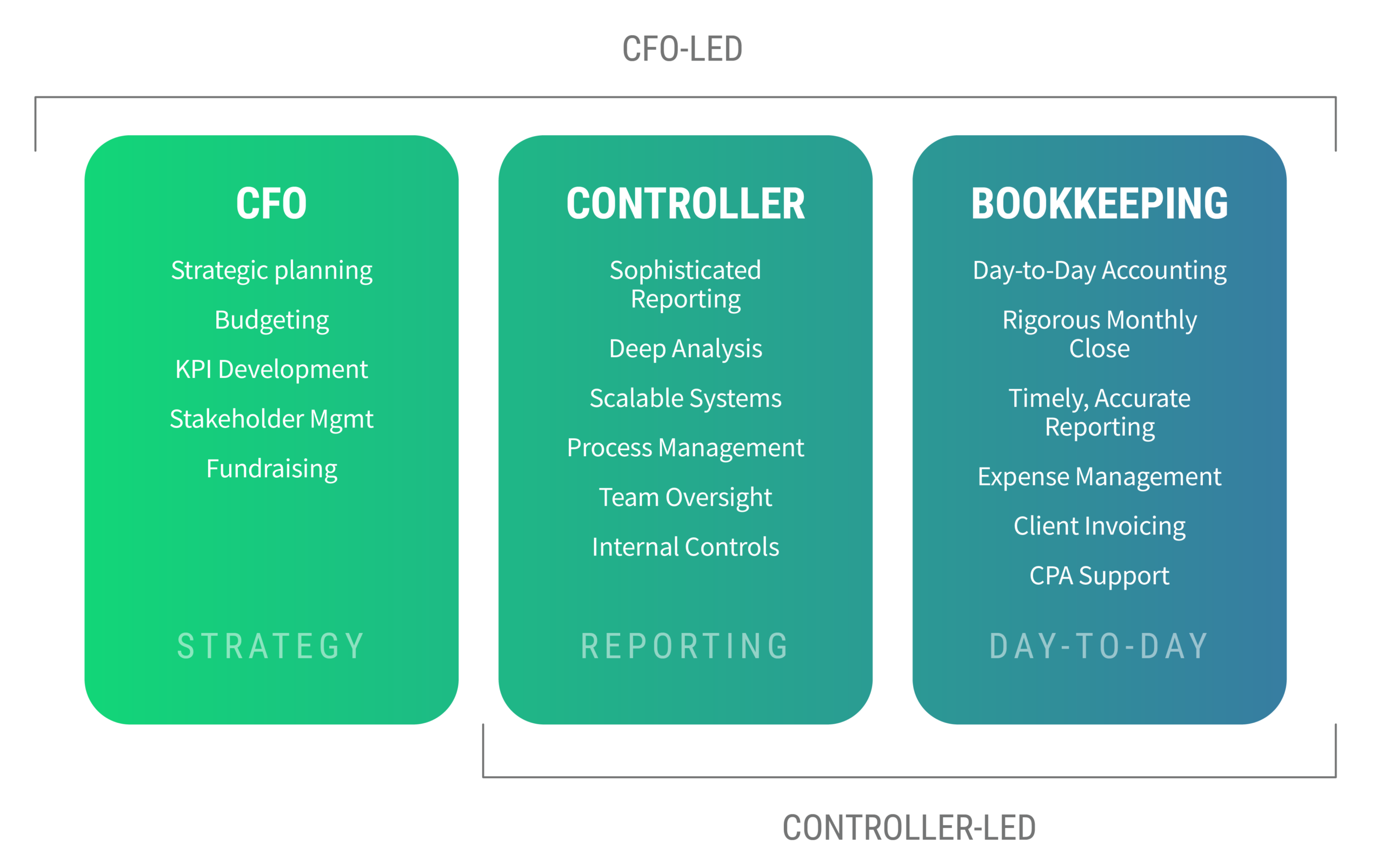

Our fractional Controllers serve as your integrated lead accountant, creating your financial strategy, implementing internal accounting procedures, and helping you navigate financial reporting—including preparing accurate and timely monthly financial reporting, supported by AI-driven insights.

They also provide senior-level oversight for purchasing, invoicing, asset management, human capital management, and cash-flow analyses, the preparation of detailed budgets and forecasts, and the analyses of their performance and benchmarking.

Learn More About BELAY'sController Services

Our fractional CFOs act as your integrated financial executive. By partnering with you, your partners, or executives, they develop and drive the overall financial strategy of your organization by developing strategic plans with a deep understanding of underlying economics.

They bring strategic knowledge and insight to provide a comprehensive service that includes conducting rigorous financial reviews, modeling, planning and analyses — supported by AI-powered forecasting tools — orchestrating strategic profit planning and execution, and actively serving as a liaison with seasoned tax experts, lenders, and investors to optimize your organization’s financial landscape.

Learn More About BELAY'sCFO Services

Our Enterprise Accounting Solutions help larger businesses streamline their systems, identify growth opportunities, and make strategic financial decisions to take their organizations to the next level. With AI-supported insights and a team of experts at every level of the financial process, we build a unified financial strategy to help you lead your business with confidence.

Learn More About BELAY's

Enterprise Solutions

Maybe you need all the help.

Maybe you only need a little.

With BELAY’s customizable outsourced financial team, we have just the right solution for you and your growing organization.

Our Accounting Professionals are experts at delivering transparent, streamlined, and accurate GAAP-compliant financial information, managing accounts payable and receivable, and generating precise monthly and annual reports — supported by AI-enhanced tools for added accuracy and efficiency. This empowers you to steer your organization efficiently, enhance your ability to analyze operations, and make informed decisions for the growth of your organization.

Learn More About BELAY'sBookkeeping Services

BELAY’s outsourced accounting services go beyond basic bookkeeping — think of us as your complete financial team. As your virtual accounting department, we handle everything from bank reconciliations and invoicing to payroll processing, sales tax filings, and financial reporting, enhanced by AI-powered tools for greater accuracy and efficiency.

With a team of professional bookkeepers and CPAs, we offer a bundled, back-office solution to keep your finances in order so you can focus on growing your business. Let us take the stress out of accounting while you lead with confidence.

Learn More About BELAY'sOutsourced Accounting Services

We support CPG companies and inventory-based businesses that manage, restock, and sell inventory. Our team streamlines processes — leveraging AI-powered insights — to create efficient, scalable operations.

With regular financial and inventory reviews, we help you stay ahead on order fulfillment, sales channels, and restocking. Whether you need an inventory management system or support for an existing one, our experts handle implementation, consulting, technical support, and data maintenance — so you can focus on growth.

Learn More About BELAY'sInventory Consulting Services

Accounting Clerks, adept financial professionals, wield their data-entry expertise to seamlessly support accounts payable, accounts receivable, and other vital transactional processes integral to the bookkeeping cycle. Leveraging AI-enhanced tools for greater accuracy and speed, they diligently organize documents and expertly apply incoming and outgoing payments with precision to ensure accurate account management.

Learn More About BELAY'sAccounting Clerk Services

Empower your business with a proactive BELAY Accounting Professional who skillfully manages every facet of payroll so you don’t have to.

From efficiently processing payroll and facilitating direct deposits to conducting precise payroll calculations and generating comprehensive year-end tax reports, our Accounting Professionals — supported by AI-enhanced tools—handle quarterly and year-end tax filing and payments with precision, going above and beyond for your financial peace of mind.

Learn More About BELAY'sFully Managed Payroll Services

Our expert CPAs handle business and personal tax preparation, ensuring compliance and minimizing stress. We review legal and tax structures for new and restructuring companies, offer strategic planning for future liabilities, and help resolve past filing issues—with the support of AI-enhanced tools for greater accuracy and insight.

Year-round, we provide tax advisory services, manage quarterly, sales, franchise, and personal property tax payments, and handle 1099 filings — so you can focus on what matters most.

Learn More About BELAY'sTax Services

Our fractional Controllers serve as your integrated lead accountant, creating your financial strategy, implementing internal accounting procedures, and helping you navigate financial reporting—including preparing accurate and timely monthly financial reporting, supported by AI-driven insights.

They also provide senior-level oversight for purchasing, invoicing, asset management, human capital management, and cash-flow analyses, the preparation of detailed budgets and forecasts, and the analyses of their performance and benchmarking.

Learn More About BELAY'sController Services

Our fractional CFOs act as your integrated financial executive. By partnering with you, your partners, or executives, they develop and drive the overall financial strategy of your organization by developing strategic plans with a deep understanding of underlying economics.

They bring strategic knowledge and insight to provide a comprehensive service that includes conducting rigorous financial reviews, modeling, planning and analyses — supported by AI-powered forecasting tools — orchestrating strategic profit planning and execution, and actively serving as a liaison with seasoned tax experts, lenders, and investors to optimize your organization’s financial landscape.

Learn More About BELAY'sCFO Services

Our Enterprise Accounting Solutions help larger businesses streamline their systems, identify growth opportunities, and make strategic financial decisions to take their organizations to the next level. With AI-supported insights and a team of experts at every level of the financial process, we build a unified financial strategy to help you lead your business with confidence.

Learn More About BELAY's

Enterprise Solutions

Your BELAY Outsourced Finance Department

Our nonprofit and business accounting services

With BELAY, you get a team of real people – not a rotating team of faceless bots – but a team of seriously skilled, servant-hearted people to provide the exact AI-empowered nonprofit and business accounting services you need.

Business and Nonprofit Accounting Services from BELAY

Everything you need for the peace of mind you deserve.

At BELAY, our mission is to equip you with the confidence to climb higher and in order to do that, it’s important to note a few things that help us do just that.

- We serve clients exclusively on cloud-based accounting systems.

- Our services are a monthly subscription paid on the first of the month.

- We have a minimum monthly subscription of $525 per month.

Our fractional Accounting Services are expertly tailored to meet your exact financial needs so you can get back to doing what only you can do: growing your organization.

THESE BRANDS TRUST OUR FLEXIBLE STAFFING. YOU CAN, TOO.

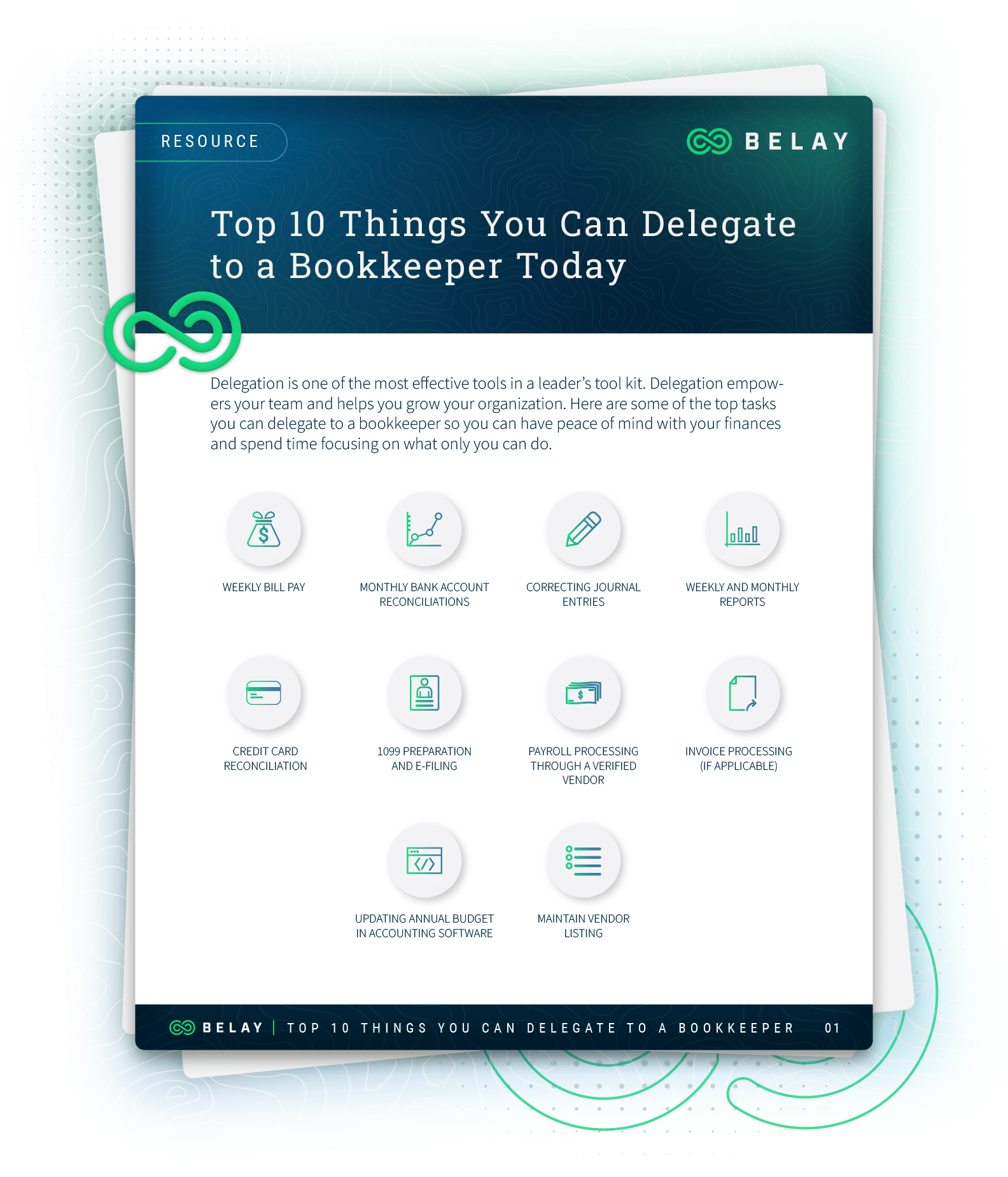

Top 10 Things You Can Delegate to a Bookkeeper Today

Here are some of the top tasks you can delegate to a bookkeeper so you can have financial peace of mind and spend time focusing on what only you can do.

DOWNLOAD

Got a question? No problem.

We've covered a lot so far. But you might still have unanswered questions about how BELAY's personalized matching process works. Allow us to ease any hesitations or concerns you may have before jumping into the process of hiring an Accounting Professional.

We are a full-service staffing solution providing fractional Bookkeepers, Accounting Clerks, Controllers, and CFOs for businesses, nonprofits, and churches.

In addition to the day-to-day accounting and financial strategy those roles provide, we also offer full-service payroll, inventory consulting, tax services, and more.

BELAY will help you build the perfect financial team to fit your needs so you only pay for what you need. And if your needs change, so can our services and support!

Of course! You’ll be assigned a Client Success Consultant who will walk through onboarding with you and who is there as a coach and resource for your entire time here at BELAY.

BELAY understands the importance of protecting you and your sensitive financial information.

In addition to our secure third-party payment system with BILL and our read-only access to bank accounts, we also have processes in place to properly vet each Accounting Professional, including conducting background checks and talking with their references to be sure we are placing a trustworthy contractor with your organization.

We have internal checks for compliance ensuring everything remains above board.

Additionally, all our contractors sign a Confidentiality Agreement to protect you and your organization. We highly recommend strong passwords and using a password manager to keep your accounts secure.

On average, our clients are matched within one week.

Your Client Success Consultant will meet with your Placement Team to discuss, vet, and select 2-3 top candidates from our bench of nearly 2,000 U.S.-based talent, and then interview and select the best match for you.

Yes, BELAY wants to be an engaged member of your team.

BELAY can customize a solution if you only need reporting and reconciliation.

Handing over the decision on who will work with you can be tough. But we know you donʼt have time to devote to screening and setting up interviews. We have a proven system to intentionally match you with someone equipped to handle everything you need accomplished.

You will have one dedicated Accounting Professional that we match you with based on your needs, industry, personality, and working style.

If, however, you work with a CFO and Bookkeeper or a CFO and an Accounting Clerk, you will work with more than one professional.

An Accounting Professional is more focused on tracking the day-to-day transactions that include paying bills, monitoring your cash flow, reconciling accounts, and preparing reports. An accountant can provide tax advice, certified audits, and a more high-level analysis of your organization's overall financial health.

Your Accounting Professional is focused on the transactional side of your needs. That responsibility is best supported by an admin team member. They can certainly provide the reports needed to show you what you spend with a particular vendor, but they will not help you shop vendors.

Absolutely – in fact, we encourage it! Our clients often hire our Professionals to utilize AI to help maximize productivity and increase efficiency.

Just schedule a call with a BELAY Solutions Consultant today!